Media

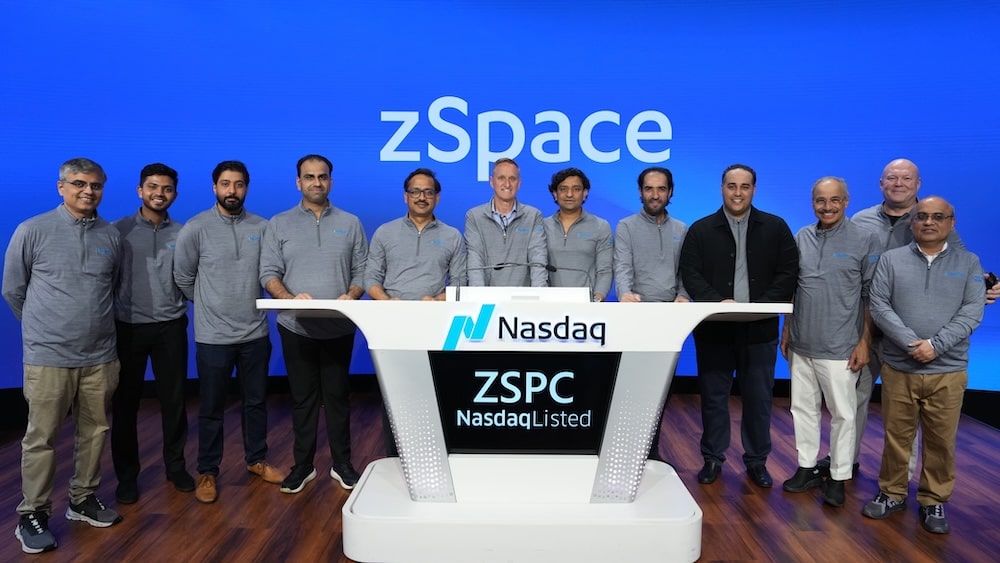

GII Proudly Celebrates the Landmark IPO of zSpace in Nasdaq Bell Ringing Ceremony in New York

Bloomberg | 08/05/20258 May 2025, Dubai (UAE): Gulf Islamic Investments (GII), a leading global alternative investment company based in the GCC, was honoured to participate in the iconic Nasdaq bell-ringing ceremony in New York City on Tuesday, May 6, 2025, marking the successful public offering of an allocation of zSpace, Inc. shares on the US Nasdaq in December 2024.

READ MORE

Management buy-out separates GRID Properties from Gulf Islamic Investments

Bloomberg | 28/10/202419 December 2024: Dubai, UAE – Gulf Islamic Investments group (GII) has sold its majority shareholding in GRID Properties to Mr. Shreen Gupta, GRID’s CEO and an existing minority shareholder in the business, in a management buy-out with the full support of GII’s Board and management.

A portfolio company of Gulf Islamic Investments (GII), a leading global alternative investment company with over $4.5 billion of assets under management, GRID Properties is an award-winning real estate solutions provider. Founded in 2018, its development portfolio exceeded $2.6 billion by 2024. GRID has an established presence in Dubai and London, partnering global brands such as Elie Saab and Marriott® Autograph.

READ MORE

GII closes $100 million capital increase to boost its growth plans

Bloomberg | 28/10/202428 October 2024, Dubai: Leading shareholders in Gulf Islamic Investments (GII), plus new investors, have added an additional $100 million growth capital to the group’s balance sheet to develop private equity opportunities across the Kingdom of Saudi Arabia and the GCC, ahead of the forthcoming Financial Investment Initiative (FII8) in Riyadh on 29-31 October 2024.

READ MORE

Gulf Islamic Investments finalises investment in GEMS Education

Bloomberg | 17/7/202417 July 2024, Dubai: Gulf Islamic Investments group (GII) has concluded its funding arrangements in a consortium led by Brookfield Asset Management Ltd., through its Special Investments (“BSI”) and Middle East private equity programmes, to invest in the Dubai-headquartered private schools operator and service provider GEMS Education.

READ MORE

Saeed Saleh Al Ghamdi appointed as new Board Member at GII Holding LLC

Bloomberg | 27/05/202427 May 2024, Dubai: Mr. Saeed Saleh Al Ghamdi brings over 26 years of experience in financial management. Mr. Saeed career path is filled with extensive diversified background including over 10 years at Procter & Gamble, followed by five years as Chief Financial Officer for the Saudi Arabian General Investment Authority (SAGIA).

READ MORE

Gulf Islamic Investments and Logipoint create powerful

Bloomberg | 25/05/202427 May 2024, Jeddah: Gulf Islamic Investments (GII) and Logipoint, a subsidiary of SISCO, have signed an agreement in Jeddah to create a joint venture for a logistics platform providing Grade A warehousing solutions across the Kingdom of Saudi Arabia in a deal worth over SAR 1 billion (approx. $300 million). Earlier this month, Brookfield Asset Management acquired a majority stake in GII’s logistics business, providing high-end, long-term clients with bespoke warehousing solutions in the UAE

READ MORE

Brookfield acquires controlling stake in GII’s logistics platform

Bloomberg | 25/03/2024May 2, 2024, Dubai (UAE): Brookfield Asset Management, through one of its private real estate funds, today announced that it has acquired a controlling stake in Gulf Islamic Investments’ logistics real estate platform. The portfolio, comprising 1.5M sq. ft. of high quality warehouses in the UAE, marks Brookfield’s foray into the logistics sector in the region. Brookfield plans to invest and scale the platform overtime through the acquisition and development of high-quality logistics real estate assets.

READ MORE

Edamah and Badia Farms partner on innovative new agricultural project in Bahrain

Bloomberg | 25/03/202425 March 2024: Manama, Kingdom of Bahrain: Bahrain Real Estate Investment Company (Edamah), the real estate arm of the Kingdom's sovereign wealth fund, Bahrain Mumtalakat Holding Company (Mumtalakat), announced a strategic partnership with Badia Farms, a leading controlled environment food producer, which will invest several million dollars in a new sustainable farm in the Kingdom of Bahrain.

READ MORE

Gulf Islamic Investments acquires a significant stake in Saudi Arabia’s Abeer Medical Company

Bloomberg | 15/01/202415 January 2024, Dubai (UAE): Gulf Islamic Investments (GII) has signed agreements to acquire a significant equity stake in Abeer Medical Company (Abeer), the largest affordable healthcare services provider in the Kingdom of Saudi Arabia, in a deal valued at an estimated SAR 600 million.

READ MORE

Rashid Centre

Bloomberg | 12/06/2023Mohammed Alhassan and Pankaj Gupta, co-CEOs of Gulf Islamic Investments (GII), had the privilege of visiting the Rashid Center for People of Determination on 5th December, in the presence of Sheikh Juma Al Maktoum, the Rashid Center's Managing Director.

READ MORE

GII and Bahrain Bayan School Collaborate on Summer Internship Program for Top Students

Bloomberg | 17/10/2023Gulf Islamic Investments group (GII) is proud to support Bahrain Bayan School's outstanding education with a commitment to take the top four Bayan students for an internship with GII in Dubai in summer 2024, as part of GII's social responsibilities programme.

READ MORE

Gulf Islamic Investments exits Amity school complex investment in a deal worth US $50 million

Bloomberg | 09/09/2023Gulf Islamic Investments Group (GII) has completed the private sale of its Amity School complex in Dubai for approximately US$50 million, the latest in a sequence of exits reinforcing GII’s position as an active asset manager for its global investors.

READ MORE

Gulf Islamic Investments strengthens its presence in the Kingdom of Saudi Arabia through its acquisition of a CMA-licensed financial company

Bloomberg | 06/07/2023Gulf Islamic Investments (GII) expanded its operations in Saudi Arabia substantially in 2023 with the acquisition of a full investment licence from the Saudi Capital Market Authority (CMA) and the planned opening of a GII office in Riyadh this year.

READ MORE

GULF ISLAMIC INVESTMENTS ANNOUNCES PRESTIGIOUS NEW COLLABORATION WITH MARRIOTT INTERNATIONAL IN LONDON TO DEVELOP THE FIRST AUTOGRAPH COLLECTION BRANDED RESIDENCES

IPE Real Assets | 27/07/2022READ MORE

Paris Towers Fetch $301 Million as Gulf Firm Bets Big on Europe

Bloomberg | 02/03/2021Gulf Islamic Investments LLC, a financial services firm that oversees nearly $2 billion, made its largest-ever real estate deal by purchasing a commercial property in Paris as part of what it called rapid investments across Europe.

READ MORE

Green Corp takes a stake in Badia Farms to expand sustainable food production across the GCC

IPE Real Assets | 07/05/2023Bahrain-based agribusiness platform Green Corp has acquired a stake in Badia Farms, the GCC’s first vertical farming company supplying gourmet produce to hotels and discerning consumers, to grow its sustainable food production projects across the GCC.

READ MORE

Al Meswak Dental Clinics acquires dental facilities in the UAE

IPE Real Assets | 02/05/2023The Saudi Arabia-based Al Meswak Dental Clinics Company (Al Meswak) has acquired two dental centres in Abu Dhabi emirate, as part of its growth strategy to expand its presence across the GCC. Al Meswak, owned by UAE-based Gulf Islamic Investments (GII) and Saudi Arabia’s Jadwa Investments Company (Jadwa), is the largest chain of dental and dermatology clinics in the Kingdom, with more than 90 facilities spread across more than 37 Saudi cities. The Al-Anees and Al-Barazi dental centres acquired by Al Meswak are amongst the most prominent dental service providers in the Al-Ain region of Abu Dhabi Emirate.

READ MORE

Gulf Islamic Investments announces prestigious new collaboration ...

IPE Real Assets | 27/07/2022Gulf Islamic Investments (GII), the leading Shariah compliant global investment company, with assets under management in the sectors of real estate, private equity and venture capital with over $ 3 billion of asset under management, has announced a new venture with Marriott International, Inc.

READ MORE

Al Meswak Dental Clinics acquires dental facilities in the UAE

IPE Real Assets | 02/05/2023The Saudi Arabia-based Al Meswak Dental Clinics Company (Al Meswak) has acquired two dental centres in Abu Dhabi emirate, as part of its growth strategy to expand its presence across the GCC.

READ MORE

UAE investor makes largest UK office acquisition outside London this year

IPE Real Assets | 04/06/2019Gulf Islamic Investments (GII) has acquired Priory Court & The Lewis Building in Birmingham for close to £140m (€158m), in what has been described as the largest UK office transaction outside London this year.

READ MORE

$50m India-focused fund to be launched by UAE financial major

Arabian Business | 14/02/2021UAE-based Shari'ah-compliant financial services firm GII set to launch its second fund targeting a range of sectors in India, with a size of about $50 million.

The proposed fund - India Growth Portfolio II (IGP-II) – is slated to be launched soon and will be deployed for investments in companies across sectors in the South Asian country.

READ MORE

Gulf Islamic Investments targets $1bn of European property investments

REACT News | 10/04/2021The UAE-based firm bought the Altaïs Towers office complex in Paris for €250m last week.

GII is looking to double the size of its European real estate portfolio by investing $800m-$1bn across the continent this year, with a focus on offices, logistics and senior housing, according to founding partner and co-CEO Pankaj Gupta.

READ MORE

UAE financial services firm GII targets $1bn growth in assets in 2021

Arabian Business | 18/02/2021Gulf Islamic Investments plans joint investment of $300m in the logistics and warehousing real estate sector in the Middle East.

READ MORE

Dubai-based Gulf Islamic Investments adds to its London assets with 60m pound West End deal

Gulf News | 13/04/2021This is GII's second major European deal in 2 months. The 60 million pound investment adds to GII's already sizeable London-focussed portfolio.

READ MORE

“GII -Tech” acquires 11% of “Nymi Band” company in Canada

PRESS RELEASE | 18/05/2017Gulf Islamic Investments Company (GII) announced that its technology investment fund, GII Tech Ventures, has acquired 11% of Canadian company “Nymi”.

READ MORE

Dubai-based Gulf Islamic Acquires Altaïs Tower in Paris for USD 302mn in Year's Largest Office Deal

Analyze Markets | 03/03/2021Gulf Islamic Investments LLC (GII), a Dubai-based investment and asset management firm, announced today the acquisition of Altaïs Tower in East Paris (the Property), for EUR 250mn (c. USD 302mn).

READ MORE

Dubai-based Rasmala sells major logistics facilities in Germany for $155m

Arabian Business | 05/12/2019Gulf Islamic Investments were co-investment advisers on the Amazon transaction, which was based on assets in the new Dortmund logistics park in Germany.

READ MORE

UAE's GII Acquires Office Building in White Plains, NY from Westport Capital Partners

Analyze Markets | 02/03/2020Dubai-based financial services firm, Gulf Islamic Investments LLC (GII), announced the acquisition of a Class A office complex,140 and 150 Grand Street in White Plains, New York (the Property), on behalf of its investors, for an undisclosed amount.

READ MORE

UAE's Rasmala and Gulf Islamic Investments Sells Two Amazon Logistic Assets for USD 155mn

Analyze Markets | 05/12/2019Dubai-based Rasmala Investment Bank and Gulf Islamic Investments (GII) announced the sale of two Amazon logistics assets (the Assets) in Dortmund, Germany, for USD 155 million, representing a total return of 30% in two years.

READ MORE

“GII Islamic REIT” acquires office property in Dubai for USD 32 m

PRESS RELEASE | 03/06/2018“GII Islamic REIT” successfully concluded the acquisition of a prime Downtown Dubai office property, spread over two floors in the highly sought after “Emaar” Square offices, in Down- town Dubai.

READ MORE

“GII REIT” signed another USD 52 m deal in Dubai

PRESS RELEASE | 12/06/2018GII Islamic REIT (CEIC) Ltd (GII REIT) has successfully signed another attractive investment worth USD 52 m in Downtown Dubai. Following the USD 32 million commercial property acquisition in Emaar square Dubai last month, this is the first residential property investment by GII REIT in a brand new development with easy access to Du- bai Mall and other popular attractions in the Downtown area.

READ MORE

2018 MENA Roundup: 10 biggest tech investment deals of the year

MenaBytes | 01/01/2019The startups in Middle East & North Africa continued to raise a lot of money in 2018. It was actually more than what they raised in 2017, the data by our upcoming platform trackMENA shows.

READ MORE

Ajman Bank signs MoU with GII-REIT

PRESS RELEASE | 26/03/2018Ajman Bank has signed a Memorandum of Understanding (MoU) with GII-REIT, through which the Bank will offer the investment in the Fund to its customers.

READ MORE

Amazon in the Middle East: Competition, regulation could stymie ambitions

S&P Global | 30/09/2019This story is the second in a two-part series documenting Amazon's ambitions in the Middle East. Part 1 focused on Amazon's market opportunity in the region amid a global sales slowdown.

READ MORE

Dubai's Mumzworld secures $20m in new funding round

Arabian Business | 02/10/2018E-commerce shopping destination for mothers in the MENA region wins new funding from Gulf Islamic Investments

READ MORE

Dubai's property market starts 2021 with bumper Dh750m+ deal for Downtown tower

Gulf News | 12/01/2021European fund snaps up Sky View hotel and residences, signalling increased buyer interest

READ MORE

GII acquires Amazon’s enormous logistics centre in Germany for US $ 144 m

PRESS RELEASE | 27/12/2017Gulf Islamic Investments today announced the acquisition of nearly one million square feet of logistics centers for amazon, on behalf of its investors, for $144 m. Rasmala has acted as a strategic co-advisor & co-investor on this acquisition assisting on all aspects of it.

READ MORE

GII acquires office building in Scotland for 44 m pounds

PRESS RELEASE | 15/01/2018Gulf Islamic Investments LLC today announced that it acquired a Commercial Building ‘WEST CAMPUS’ situated in Westhilll Business Park Aberdeen, Scotland on behalf of its investors، for 44 m. pounds.

READ MORE

GII announces launch of GCC’s First Shariah Compliant Monthly Dividend REIT

PRESS RELEASE | 31/05/2017First GCC based REIT that will have some international real estate exposure as well (UK & US), with blue chip existing tenants. AED 500 million seed investments for the REIT already committed by GII’s investor group.

READ MORE

GII Appoints Northacre As Development Manager For Former Chelsea Police Station Project

PRESS RELEASE | 13/02/2017GII investing 100 million pounds to develop a premium residential apartment building in London.

READ MORE

GII appoints Northacre to develop former SW3 police station

EG Radius | 13/02/2017Gulf Islamic Investments has appointed Northacre as development manager for the luxury residential redevelopment of the former Chelsea police station.

READ MORE

GII expands investments into the lucrative transportation and logistics

PRESS RELEASE | 09/05/2017Gulf Islamic Investments LLC (GII) successfully completed a Sharia compliant growth capital financing round for Bion Group and further expands its investment portfolio with a foray into the lucrative transportation and logistics industry.

READ MORE

GII forays into US real estate market with acquisition of commercial property in Pennsylvania

PRESS RELEASE | 21/06/2016Gulf Islamic Investments today announced that it advised/ acquired on behalf of its Investors, a Class A Commercial Building ‘3501 Corporate Parkway’ situated in Center Valley (Allentown) Pennsylvania, United States of America.

READ MORE

GII Investing 100 million Pounds to develop premium residential apartments in London

PRESS RELEASE | 20/09/2016Gulf Islamic Investments is leading a development of premium residential apartments at a prime location in Chelsea, London. The property was a former police station located in West Chelsea, south west London (SW3) within the highly desirable Royal Borough of Kensington and Chelsea at the Southern end of Lucan Place with further frontages onto Petyward and Makins Street.

READ MORE

GII officially launches GCC’s first monthly dividends REIT, out of DIFC, Dubai

PRESS RELEASE | 21/12/2017IPO of GII- REIT, targeted for second quarter 2018. Initially the REIT will be open to sophisticated investors.

READ MORE

GII receives approval on revised Scheme for the 2 Lucan Place Project

Saudi Gazette | 06/05/2020Gulf Islamic Investments received planning permission on the revised scheme for 2 Lucan Place property from the Royal Borough of Kensington and Chelsea (RBKC).

READ MORE

GII Successfully Raises US$200 million for Silicon Valley Technology Companies and Prepares to Launch GII TECH

PRESS RELEASE | 07/10/2015Gulf Islamic Investments announced today that it has successfully raised venture capital funding for multiple Silicon valley based technology companies over the last ten months. The total amount raised is close to US$ 200 million.

READ MORE

Gulf Islamic Investment buys property in New York state

The National | 01/03/2020The latest deal brings the value of GII's real estate portfolio in the US to more than $230 million

READ MORE

Gulf Islamic Investment LLC raises US. $145 million for Silicon Valley Technology Company “APTTUS.”

PRESS RELEASE | 14/11/2016Gulf Islamic Investments today announced the successful closing of US.$145 million fundraising for APTTUS, a Silicon Valley based company delivering Enterprise Class, Software-as-a-Service (Saas) Solutions to complete the Quote-to-Cash customer process and the Procure-to-Pay supplier process.

READ MORE

Gulf Islamic Investments Concludes the Acquisition of More Café and expands its focus into the UK Real Estate.

PRESS RELEASE | 13/09/2015Gulf Islamic Investments today announced the closing of the acquisition of MIF Inc., the holding company behind leading UAE home-grown all-day casual dining brands. MIF Inc. owns the More Café™ and Little More™ Brands, which they have franchised to leading food operators in the UAE, Oman and other territories. MIF Inc. was acquired by a syndicate of GCC investors, advised by Gulf Islamic Investments.

READ MORE

Gulf Islamic Investments plans to invest $600m this year

The National | 26/04/2021Dubai-based company to spend about $400m on property and $200m on private equity deals as it pursues $3bn in managed assets by end of year

READ MORE

Gulf Islamic Investments raises AED 145 million for the largest Indian school in UAE

PRESS RELEASE | 19/09/2017A plan to increase investments in education sector in GCC, GII investments in UAE market reach AED 900 million.

READ MORE

Gulf Islamic Investments yield generating portfolio touches USD 50 million

PRESS RELEASE | 18/05/2015With the latest Sale and Leaseback Transaction in Dubai Investment Park, and Expands its Focus to the GCC Food Production and Food Service Industry.

READ MORE

Gulf Islamic Investments: Providing a diverse set of investment opportunities

Arabian Business | 31/10/2019Gulf Islamic Investments and its team enjoy a track record of managing $2.8 billion in assets and securing $5.6 billion in debt and in excess of $1.2 billion in equity.

READ MORE

Realogy HQ Office Building in Morris County Sold to Foreign Investor

GlobeSt | 22/08/2019Gulf Islamic Investments has acquired the headquarters of Realogy here from The Hampshire Companies.

READ MORE

Savills IM buys €140m German logistics properties for Korean investors

IPE Real Assets | 10/12/2019The two at Kaltbandstrasse 4 and Warmbreitbandstrasse 3 in Dortmund are let to Amazon

READ MORE

UAE investment firm buys Scottish offices for $60m

Arabian Business | 26/01/2018Gulf Islamic Investments acquires commercial building in Westhill Business Park, Aberdeen

READ MORE

Valencell Secures $11 Million in Series D Funding

PRESS RELEASE | 07/03/2016Funding will accelerate Valencell’s growth, expand R&D, and drive continued customer success in biometric wearables and hearables.